Sheffield Property Investment

Known by many as the Steel City due to its industrial heritage, Sheffield is another example of the excellent progress being made by the Northern powerhouse – with a growing economy and a population now in the top 10 highest in the UK. As a result, property investment in Sheffield has been steadily increasing in recent years.

Read on to learn about Sheffield property investment, including past and future performance of the local market, a list of the best buy to let areas in Sheffield, and more.

Find Your Next Property

Sheffield: A Summary

Sheffield is a city known for its industrial mastery and thriving university scene, along with a more recent boom in the business sector.

The local economy is currently worth circa £7bn per year and the Sheffield City Region (SCR) aim to continue this growth with a 20 year economic plan put in place in 2021, which aims to add an extra £7.6bn GVA to the local economy.

The city is home to two of the UK’s leading higher education institutions, the University of Sheffield, which is part of the Russell Group of universities, and Sheffield Hallam University.

In total, the city houses around 63,000 students and, positively for the city’s growth, more than 25% of graduates choose to stay permanently after they complete their degrees.

As a property investment company Sheffield has everything we look for in a city: growth, business, culture, tenants, transport, jobs and more. It’s a brilliant choice for any investor.

Sheffield Property Investment Opportunities

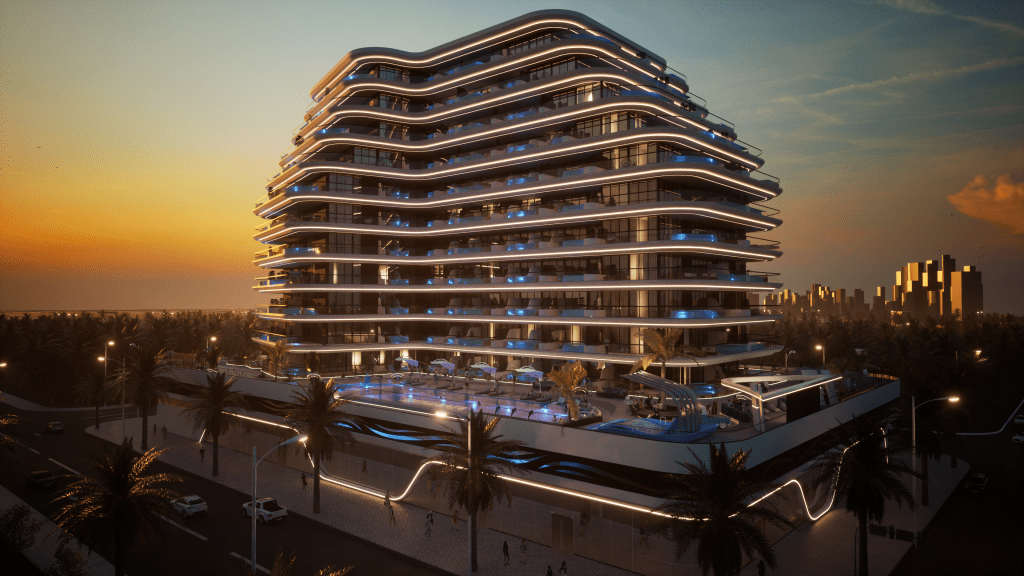

Kiln House, Stoke-on-Trent

- Stoke-on-Trent

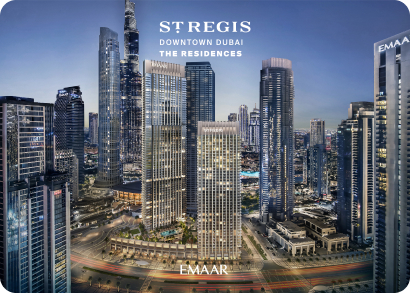

Plough Maltings, Burton-upon-Trent

- Burton-Upon-Trent

The Villas, Stoke-on-Trent

- Stoke-on-Trent

Why Sheffield?

There are two excellent reasons to consider Sheffield.

First, the local property market has shown fantastic growth over the last few years. Even now though, property prices are much lower than other parts of the country. Sheffield may well be undervalued given it’s growth potential.

Second, there will be high demand for housing in the future as Sheffield’s economic plan aims for a growth in population of 70,000 before 2025.

The graph on the left shows the change in property prices across Sheffield as a whole since 1995.

It shows that since the global recession of 2009, property prices have steadily increased in Sheffield. In fact, since January 2010, prices have increased by 42.3%.

The data is further evidence of the city’s progress in the past decade, with more expected over the coming years.

The graph on the right shows the projected change in population for Sheffield up till 2043.

Research from the Office for National Statistics suggests Sheffield’s population will swell to just shy of 650,000 over the next 20 to 25 years.

As a result, there will be a growing number of people looking for property in the city. Sheffield property investors stand to benefit from the increase this will have on demand for high-quality, central accommodation.

Property Value Forecast

Local Economy

Employment

Best Areas

In our opinion, there are three exciting, high potential areas for consideration when looking into property investment in Sheffield, which we have picked out below.

City Centre

With a population of 30,000 made up largely of students and young professionals, Sheffield’s city centre is probably the best place to consider for investment. Plus, as shown in the graphs above, the city centre postcode, S1, achieves the strongest average yields in the region. Properties in the centre are a mix of new-build blocks and period conversions, offering a variety of options for investors and renters.

East Sheffield

East Sheffield is one of the most affordable parts of the city, but it offers excellent rental yields as a result.

See our yield map above and look out for the S2 postcode. Located between Sheffield and Rotherham, the east plays host to suburbs such as Brightside, Burngreave, Parson Cross, and Attercliffe.

South East Sheffield

South East Sheffield has a large variety of properties, but it is particularly popular with family-sized buy-to-lets. The average price ranges between £170,000 – £200,000, and investors can achieve a comfortable average yield between 4 – 5%. One benefit of this area is the transport, with many suburbs linked together by the tram network. The South East of Sheffield has two up-and-coming areas where interest is building, Heeley and Meersbrook, but for more good value investors may also want to consider Frecheville, Hackenthorpe and Beighton.

Why Work With Us?

Reputation

We’ve built a reputation as an ethical, knowledgeable and experienced property investment company in Sheffield. We use our understanding of the local market to find high-quality property investments, which come at no cost to our clients.

Exclusive Access

We’re often able to get deals that aren’t available to the public. For example, free furniture packs, Stamp Duty support, and even price discounts. For this reason, we tend to look for off-plan properties.

Experience

We’ve helped hundreds of property investors in the UK and abroad to purchase investment properties in Sheffield. The city is our first choice pick for new and experienced investors due to the stunning market performance and accessible prices.

Total Support

Finally, we guide you through the entire journey. From a free consultation to extensive due diligence, to finding a mortgage provider and after-sales support. We’re here to help you achieve your property investment goals.