Property Investment Dubai

![]() Work with Track Capital and our team on the ground to invest in Dubai property; we’ll find the perfect opportunity and provide expert support from start to finish.

Work with Track Capital and our team on the ground to invest in Dubai property; we’ll find the perfect opportunity and provide expert support from start to finish.

![]() As a property investment company specialising in buy-to-lets, we can help you gain exclusive access to a range of complete and off-plan properties, perfect for buy-to-let in Dubai.

As a property investment company specialising in buy-to-lets, we can help you gain exclusive access to a range of complete and off-plan properties, perfect for buy-to-let in Dubai.

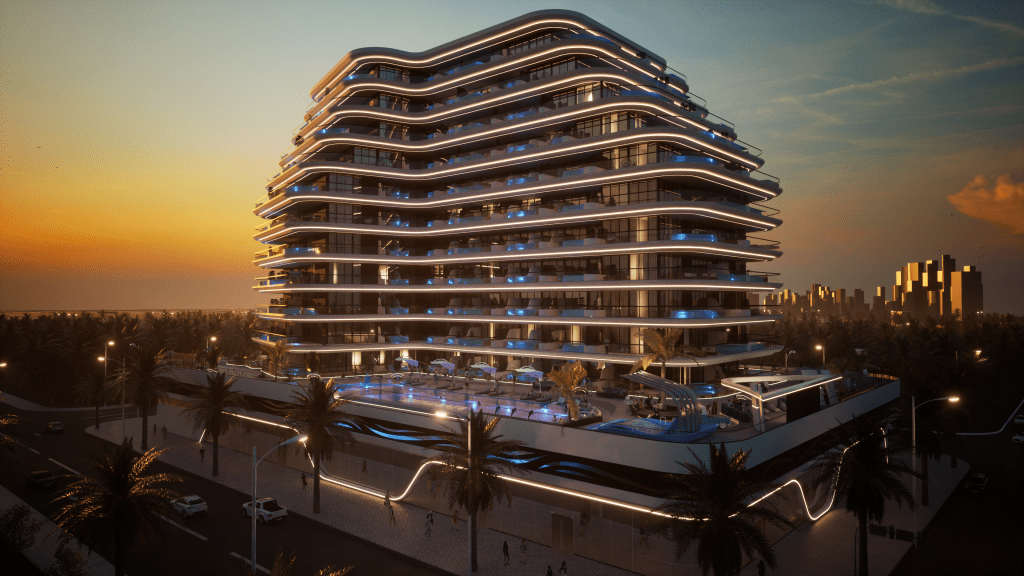

![]() Purchase world-class apartments with downtown views from £130,000 (600,000 AED), with investor-friendly deposit levels and payment plans.

Purchase world-class apartments with downtown views from £130,000 (600,000 AED), with investor-friendly deposit levels and payment plans.

![]() Benefit from tax-free and freehold property investment opportunities.

Benefit from tax-free and freehold property investment opportunities.

Members Of The Property Ombudsman Scheme

Access Our Full Range Of Investment Property Deals

Properties Available In Dubai

Why Invest In Dubai Property?

With a team on the ground operating from our office in Dubai Marina, as well as our London office, we are on hand to assist from start to finish for non-resident investors buying in the UAE.

Whether it’s for a buy-to-let investment, a personal residence, or a holiday home, let us help with the following:

- Property & Developer Selection Consultancy

- Construction Updates & Site Visits

- Bespoke Payment Plans & Mortgages

- Lettings & Property Management, Including Short Term Lets

- Post Handover and After Sales Assistance

View our range of publicly available properties in Dubai above, or get in touch to view off-market opportunities.

Mortgages

Track Capital has direct contact with developer in-house mortgage brokers to help our investors secure attractive interest rates and loan to value ratios of 50% from £150,000 properties.

Payment Plans

Dubai’s property developers offer appealing payment plans to minimise capital expenditure. Benefit from staged payments during and after construction.

Developer Quality

The quality of property developers in Dubai means substantial track records can be shown, along with a stunning finished product. We encourage you to come and see for yourself, with many developers offering paid-for trips.

Market Performance

Dubai’s brand, and its property market, continues to grow exponentially meaning capital growth and rental yields are strong.

In particular, a short term letting model can achieve a higher than average ROI.

Why Work With Track Capital?

Frequently Asked Questions

01. Can non-residents buy property in Dubai?

In 2002, the UAE passed the Freehold Law, which allows foreigners to freely buy, sell, let, and rent property across the country. As a result, property investment in Dubai from individuals and companies in the UK (and elsewhere) has grown significantly over the past 20 years.

02. Do I need to pay stamp duty in Dubai?

Stamp Duty Land Tax (SDLT) is not applicable in Dubai, regardless of whether you’re based in the UK or not. Instead, a one-off payment of 4% of the property’s value must be made to the Dubai Land Department (DLD).

03. I’m a UK resident, will I need to pay tax on my rental income from Dubai?

If you’re a tax resident in the UK then it’s likely income tax will be due from your rental property in Dubai. Furthermore, Capital Gains Tax will be due if you sell the property for a profit in the future. This is the same for any property regardless of where it is in the world, so it’s worth speaking to our team, and an experienced tax advisor, to find out more and discover the most tax-efficient way to invest in property domestically and abroad. However, you won’t be taxed from Dubai itself.

04. I’m not based in the UK, can you help me invest in Dubai?

Yes, we assist real estate investors all across the world – whether they’re based in the UK, the UAE, or elsewhere. We have a truly global client base of investors from almost every continent, and our team can speak several languages. We can also assist with mortgages. Get in touch to learn more.

05. Should I focus on off-plan or ready properties in Dubai?

Off-plan property investment in Dubai offers buyers the chance to get in early and purchase a brand-new property before the development is complete. Alternatively, buyers can find a property that’s already complete on the secondary market.

We tend to lean towards new build, off-plan properties, for two main reasons:

- Developers usually offer discounts or sell properties below market value during construction, meaning investors can snag excellent deals

- The market continues to develop while construction is underway, meaning your property’s value may have increased by the time it’s ready to let (allowing for a quick and profitable exit if you wish)

Of course, there is a risk a development still under construction will experience delays or, in rare circumstances, cancellation. This is why it’s critical to do your research, pick one of Dubai’s most trusted, experienced developers, and ensure your money is protected – all of which we can help you with.

06. What should I look for in a buy-to-let in Dubai?

Like any property investment, a successful buy-to-let in Dubai should deliver a predictable and profitable return over time through a balance of attractive rental yields and capital appreciation. To achieve this, there are a few things to consider when looking at a property:

- Location: Picking the right location is probably the primary factor in determining ROI, after all, you should buy somewhere people want to live. Dubai is famous for its different neighbourhoods, each with a unique character and way of life. A few popular examples include Dubai Marina, known for its nightlife, and Jumeirah, known for its beaches.

- Features: Is it a corner apartment, is it well furnished, is there an ensuite bathroom, does it come with a parking space or balcony? Better or unique features will attract more tenants and boost your rental price.

- Amenities: What’s in the local area that will make people want to move here? Is this prime real estate? Consider the selection of local cafes, restaurants, schools, shops, supermarkets, transport options, and more.

07. What’s involved with purchasing a buy-to-let in Dubai?

To get started, we’ll organise a call with you to learn more about your budget, goals, and criteria.

Then, we’ll review Dubai’s real estate market and suggest several suitable developments and residential properties. We can answer any questions you have about the developments, and we’ll make sure you fully understand everything about what happens next.

If you choose to move ahead, we’ll support you through the purchase process, from the reservation fee to the down payment to the exchange of contracts (we can introduce you to mortgage brokers, if required). If you’ve opted for an off-plan property, we’ll provide regular construction updates as the project progresses.

And then, once the property is nearly ready to let, we’ll ensure you have a suitable lettings and management company in place, meaning you can be a hands-off investor.