One of the most common questions we receive from new or prospective property investors is, “How do I calculate rental yield?”.

There are two types of rental yield you may want to work out: gross and net. Fortunately, both are easy to do, although the latter has one extra step.

In this guide, we’ll discuss rental yield formulas and examples for gross and net, but please note that we’ll use Pound Sterling as our currency throughout as a company based primarily in the UK. The formulas work the same wherever you’re based, so just substitute the currency for your own.

How To Calculate Gross Rental Yield

The first is gross yield. Gross yield presents a rental property’s return (or potential return) before costs, e.g. maintenance, insurance, tax. You can calculate the gross yield of any property with the following formula:

((Monthly Rental Income × 12) ÷ Property Value) × 100 = Gross Rental Yield

Steps:

- Take your monthly rental income (or estimated income)

- Multiply the monthly income by 12 to work out your annual gross income

- Divide the resulting sum by the price you paid (or will pay) for the property

- Multiply this figure by 100 to convert it into a percentage

- The answer is your gross rental yield

Example

If you buy a property worth £200,000 and you rent it out for £1,000 a month, your gross rental yield is 6%. See each step of the calculation below:

((1,000 × 12) ÷ 200,000) × 100

(12,000 ÷ 200,000) × 100

0.06 × 100 = 6%

How To Calculate Net Rental Yield

The second type of rental yield is net. Net yield is the return (or potential return) of a rental property after costs, e.g. maintenance, insurance, tax. You can calculate the net yield of any property with the following formula:

(((Monthly Rental Income × 12) – Costs) ÷ Property Value) × 100 = Net Rental Yield

Steps:

- Take your monthly rental income (or estimated income)

- Multiply the monthly income by 12 to work out your annual gross income

- Minus the total costs for the property over the year to work out your annual net income

- Divide the resulting sum by the price you paid (or will pay) for the property

- Multiply this figure by 100 to convert it into a percentage

- The answer is your net rental yield

Example

If you buy a property worth £200,000 and you rent it out for £1,000 per month, with expenses of roughly £3,600 per year, then your net rental yield is 4.2%. See each step of the calculation below:

(((1,000 × 12) – 3,600) ÷ 200,000) × 100

((12,000 – 3,600) ÷ 200,000) × 100

(8,400 ÷ 200,000) × 100

0.042 × 100 = 4.2%

Net vs gross yield – which should I use?

Net rental yield is harder to calculate as costs can be variable and difficult to estimate. Nonetheless, having a rough idea of net yield is valuable as it provides a more accurate view of your return on investment.

By comparison, gross rental yield is very easy to work out. It can be done on the fly when you’re initially researching a potential investment without needing to estimate costs.

Investors may also find it helpful to compare gross and net yields. A good rule of thumb is that the difference between gross and net should be no more than 1-2%. For properties with a larger difference, a smart investor should look for potential cost savings or consider increasing the monthly rental price.

One added advantage of working out this difference is that, amongst a multi-property portfolio, you’ll identify the best and worst performers. The worst performers may be good candidates for selling, as you could re-invest that money elsewhere for more substantial returns.

Calculating and tracking rental yields over time

Every property investor should have a spreadsheet to keep track of rental yields over time, regardless of whether you’re a residential buy-to-let investor or a commercial property owner. It’s okay to fill this out with estimates if you don’t have all the data to begin with, but you’ll build a historical record of yield performance over time.

And that’s an instrumental dataset as you progress through your property journey.

To make things easy, we’ve created a completely free spreadsheet, which you can download here:

This is a template for Google Sheets. We’ve barred any edits, so the template remains clean for everyone. To use it, you’ll need to click on “File” in the menu, then either select “Make a copy” to duplicate it into your own Google Drive or select “Download” to get a hard copy on your computer.

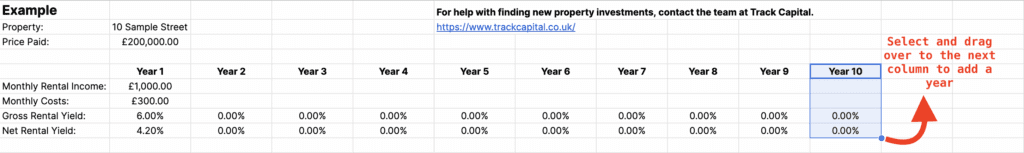

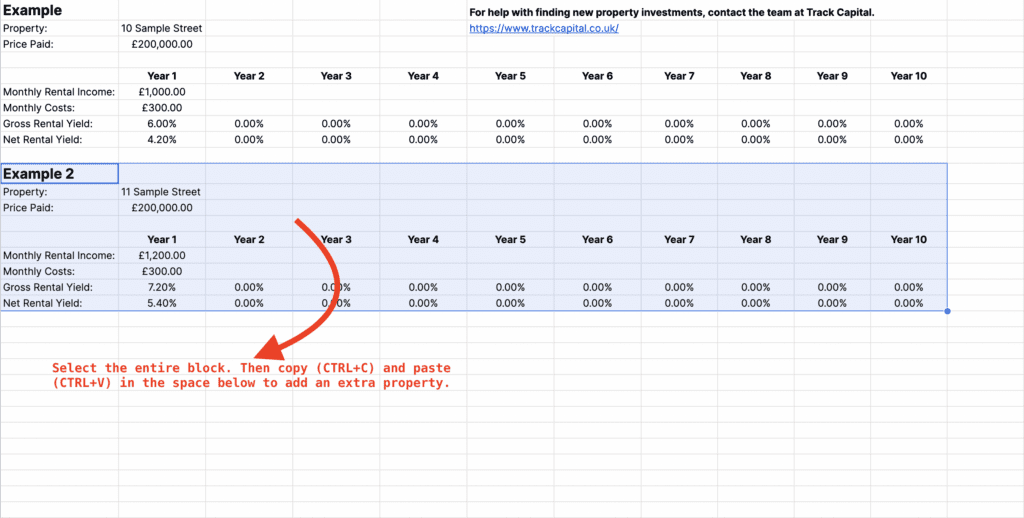

Once you’ve got your copy, just update the cells for your property name, value, monthly rental income, and monthly expenses. The spreadsheet will then calculate your gross and net rental yields.

If you need to add more years, just copy and paste a new column to the side:

If you need to add a new property, just copy and paste the whole section below:

FAQs

What’s a good rental yield?

The average rental yield across the UK usually measures around 3.5% – 4%. By that standard, anything higher than 4% is above average.

But, you should aim for better than just above average. Especially given the value still available in the market and the solid rental performance in major cities like Manchester and Liverpool. We’ve posted about this topic in more detail previously, in which we suggested that a figure between 5-8% can be considered a good rental yield. Check out the post to learn more.

Why does rental yield matter?

As a landlord, the rental income from a property should not only cover all expenses (mortgage payments, maintenance, taxes, etc.), but it should also provide an additional, relatively passive income stream for you and your family. Rental yield, and in particular net rental yields, are a great measure of whether a property is achieving this level of profitability.

How can I increase my rental yield?

If your rental yields are low and the property is not making money, then you may want to consider the following measures to improve your yield:

- Review whether your rental price is in line with the market rate.

- Update the property. A refurb or refresh can attract tenants willing to pay more or stay longer (thus reducing void periods).

- Review your expenses. For example, you may be able to find better deals on insurance costs or even take a more active role in doing repairs.

So, in summary:

- Rental yield is a measure of rental profitability

- There are two types: gross and net yield

- Gross calculates yield before expenses, whilst net calculates yield after expenses

- The difference between the two should be no more than 1-2%

- Use both to assess potential investments and track the performance of your portfolio

- Good rental yields typically range between 5-8%

- If your yields are low, you may not be making enough to cover all of your expenses, so it’s wise to consider means of improving profitability